Company formation overseas: the practical playbook

Expanding into a new jurisdiction can unlock customers, capital, and talent. The process becomes straightforward when you select the right structure, prepare complete documentation, and engage reliable local partners.

1) Choose the right structure

Decide between limited liability, branch, free zone, or holding company models. Balance liability protection, shareholding flexibility, and reporting requirements with your growth plan.

2) Pick a jurisdiction fit for your model

- Evaluate regulatory stability, banking environment, and treaty networks.

- Check sector licenses and foreign ownership rules in advance.

- Consider operational factors like time zone, language, and talent pool.

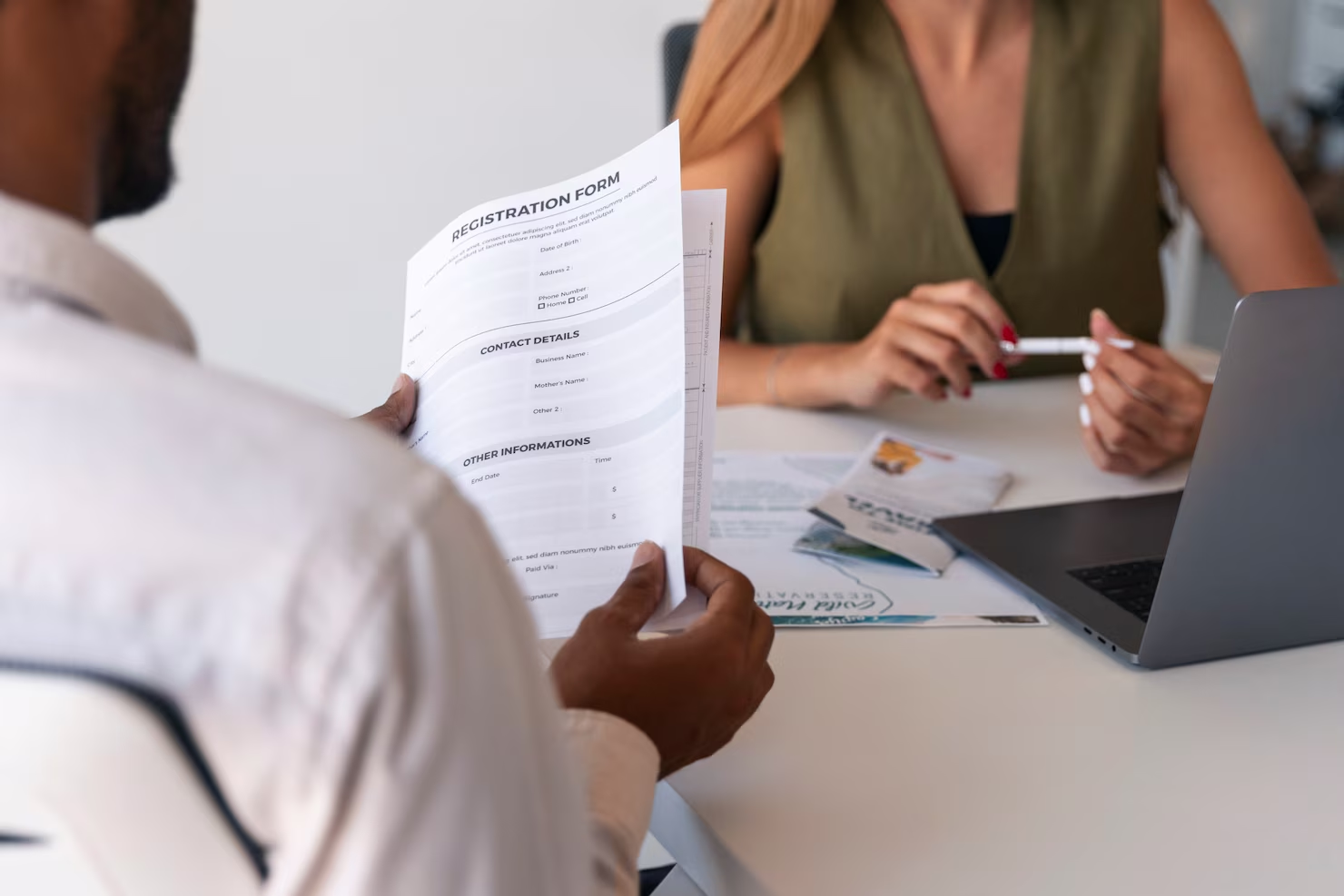

3) Prepare documentation

- Shareholder IDs, corporate resolutions, and proof of address.

- Memorandum and Articles, business plan, and KYC forms.

- Notarization, legalization, and translations where required.

4) Name reservation and licensing

Reserve a compliant trade name, register the entity, and apply for activity specific licenses. Clarify scope to avoid future amendments.

5) Banking and finance setup

Open a corporate bank account, set treasury processes, and implement bookkeeping standards. Define approval workflows to reduce operational risk.

6) Tax and compliance

Register for tax, understand filing deadlines, and align invoicing with local rules. Keep permanent records to support audits and cross border transactions.

7) People and premises

Secure office lease or flex space, draft compliant employment contracts, and apply for staff visas if applicable.

How PG International helps

We map your goals to the right jurisdiction, coordinate document legalization, secure licenses, introduce banking partners, and implement a compliance calendar so you operate with confidence from day one.

Reminder: Laws evolve. Always confirm current rules before filing.